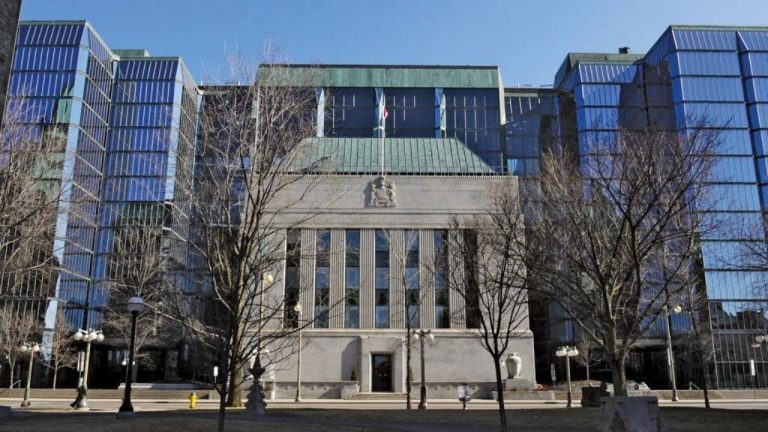

The Bank of Canada has announced a reduction in its target for the overnight rate to 3.25%, with the Bank Rate at 3.5% and the deposit rate at 3.25%. This decision aligns with the Bank’s ongoing balance sheet normalization policy and signals an opportunity for buyers and sellers in Canada’s housing market.

Economic Overview: A Mixed Global Picture

Globally, economies are evolving essentially, as anticipated in the Bank’s Monetary Policy Report. The U.S. economy remains resilient, supported by strong consumer spending and a solid labour market. Inflation in the U.S. is steady but elevated in some areas. In contrast, Europe faces slower growth, while policy actions and exports support China’s growth, though consumer spending remains sluggish.

In Canada, the third quarter saw a 1% growth in GDP, slightly below projections. However, consumer spending and housing activity have increased, indicating that lower interest rates already positively influence household decisions. While employment growth has slowed, wage increases remain steady, giving potential buyers greater purchasing power.

Canadian Housing Market Impacts

For homebuyers, the reduction in interest rates presents a unique opportunity to make mortgages more affordable, creating an excellent chance to enter the market or upgrade to a dream property. Sellers, too, stand to benefit as lower rates often drive increased buyer activity, leading to a more dynamic and competitive market.

Key Policy Changes Impacting Real Estate

Several recent policy measures are set to influence the real estate landscape:

-

Temporary GST exemptions are offering financial relief to households.

-

One-time payments provide extra resources for individuals and families.

-

Revised mortgage rules are helping improve affordability for prospective homebuyers.

Combined with the Bank’s lower rates, these adjustments are poised to create a dynamic and favourable housing market.

Why This Matters for You

-

For Buyers: Lower interest rates mean reduced mortgage costs, making it an excellent time to secure your dream home or invest in property.

-

For Sellers: Increased buyer activity could lead to more competitive offers and higher demand for listings, giving you an edge in today’s market.

Looking Ahead

Inflation remains close to the Bank’s target of 2%, with moderate price pressures in housing and goods sectors. Temporary federal and provincial policy measures, such as the GST suspension on select consumer products and changes to mortgage rules, may influence short-term dynamics but are not expected to disrupt the overall trend.

The Bank of Canada has emphasized its unwavering commitment to maintaining price stability and supporting economic growth, signalling a focus on measured and responsive policy adjustments as needed. This commitment should provide reassurance and confidence in the stability of the market.

A Bright Future for Buyers and Sellers

As we move forward, this reduction in interest rates is a positive development for Canada’s real estate market, paving the way for potential growth. Buyers can enjoy more favourable borrowing conditions, while sellers may benefit from an influx of motivated purchasers.

Whether you’re planning to buy your first home, upgrade your current one, or sell to start a new chapter, this is an exciting time to explore opportunities in the Canadian real estate market. If you’re considering a move, now might be the perfect moment to take advantage of these favourable conditions. Visit All Points North Group to browse current listings, or contact our team for expert advice tailored to your needs.

All Points North Group are here to help Canadians be where they want to be and achieve their real estate dreams, one step at a time.

How will you make the most of this opportunity? Let us know—we’d love to hear from you!

The following scheduled announcement for the overnight rate target will occur on January 29, 2025. At that time, the Bank will also release its whole economic and inflation outlook, including an assessment of the risks to the projection, in the Monetary Policy Report (MPR).